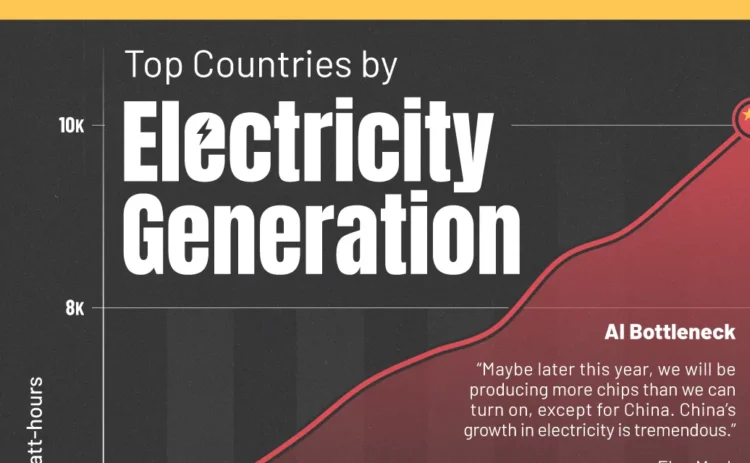

China has cemented its position as the world’s leading electricity producer, generating more than double the power of any other country. According to a recent Visual Capitalist report, China’s electricity output grew by 74% between 2014 and 2024, surpassing 10,000 terawatt-hours (TWh) in 2024. This marks a decade of unprecedented expansion, driven by industrial growth, urbanization, and a booming manufacturing sector.

In 2014, China produced about 5,795 TWh of electricity, already ahead of the United States. By 2024, the figure reached 10,087 TWh. Meanwhile, the U.S. increased output modestly from 4,363 TWh to 4,635 TWh over the same period—a mere 6% rise. China now generates nearly five times the electricity of India, which has also shown strong growth, increasing its output from 1,259 TWh in 2014 to 2,030 TWh in 2024.

U.S. tech billionaire Elon Musk highlighted China’s advantage at the World Economic Forum in Davos, Switzerland. He said, “China’s growth in electricity is tremendous,” noting that the country’s abundant and low-cost power supply supports the expansion of AI models and data centers.

Russia and Japan have shown far less dramatic growth. Russia’s electricity production grew from 1,064 TWh to 1,209 TWh over the decade, while Japan’s output remained largely flat, standing at 1,016 TWh in 2024. Factors including demographic challenges, slower economic expansion, and shifts in energy strategy contributed to Japan’s stagnation.

Rapid Growth in Electric Vehicles

Electric vehicle (EV) adoption is accelerating worldwide, with Norway leading in terms of market share. By 2025, EVs are expected to account for 97% of new car sales in Norway, up from 56% in 2019. Nepal ranks second globally, with 73% of new vehicles projected to be electric, a significant jump from just 8% in 2019.

China remains the largest EV market by volume. Sales are projected to exceed 13 million vehicles in 2025, representing 53% of all new car sales in the country. In comparison, the U.S. and Canada are expected to have 10% and 9% EV shares, respectively.

Europe shows broad-based EV adoption, with countries like the Netherlands (56%), Belgium (43%), Portugal (37%), and the United Kingdom (33%) experiencing significant gains since 2019. Even nations with historically slower adoption, such as Italy and Spain, have achieved double-digit market shares. Germany alone is estimated to sell more than 840,000 EVs in 2025.

EV Charging Infrastructure

The deployment of charging infrastructure is keeping pace with EV adoption, though challenges remain. The Netherlands leads globally in EV charger density, with just five EVs per public charger. China ranks second in charger density, with nine EVs per public charger, but it dominates in fast-charging deployment. Nearly half of China’s public chargers are direct current (DC) fast chargers, a proportion expected to surpass 50% by 2030.

Europe has also made significant progress. Countries including Sweden, Finland, and Denmark now have over 50% of new car sales as EVs, with fast-charging infrastructure steadily expanding. In contrast, the United States lags behind, with 31 EVs per public charger as of 2025.

These developments underscore the global shift toward electrification and the strategic advantage of abundant power supplies, particularly for nations like China. As countries invest in energy generation and EV infrastructure, the pace of global electrification is expected to accelerate in the coming decade.