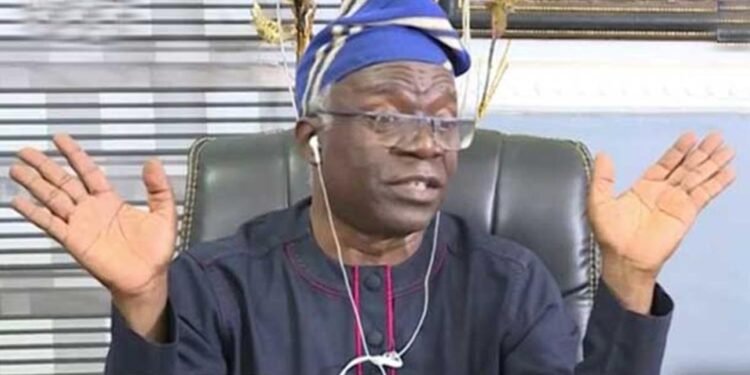

Human rights lawyer and Senior Advocate of Nigeria (SAN), Femi Falana, has warned that the new tax laws scheduled to take effect on January 1, 2026, cannot be implemented until allegations of forgery and unauthorized insertions are properly addressed.

Falana made this statement on Wednesday while speaking with journalists at his hometown in Ilawe-Ekiti. He said the Federal Government should have used the final days of 2025 to resolve the controversies and release clean, verified copies of the tax laws before their commencement date.

According to him:

“If that was not done, the government will put itself in trouble by deciding to implement the laws. There are interest groups ready to challenge the legitimacy of the laws.”

There have been claims that some provisions were secretly added to the tax bills after they were passed by the National Assembly. This has raised concerns that the laws signed by President Bola Tinubu on June 26, 2025, may be different from what lawmakers originally approved.

Falana questioned which version of the laws the government plans to implement.

“The laws cannot take effect until the controversies surrounding the legitimacy of the provisions are addressed. There are questions about the authentic tax laws, so which laws are we talking about?” he asked.

“Until we have clean copies of the tax laws, you cannot talk about a commencement date.”

He described the allegations as serious, noting that some people have even called them forgery. Falana blamed the National Assembly for the situation and criticized the lack of transparency.

“In this day and age, it is unacceptable that we cannot access bills passed by the National Assembly and signed into law by the President,” he said, questioning why the laws are not publicly available on the National Assembly’s website.

While President Tinubu has insisted that the tax reforms will take effect as planned and described them as a “once-in-a-generation opportunity” to strengthen Nigeria’s economy, Falana disagreed, insisting that legitimacy must come first.

He also warned that governments at all levels must justify the collection of more taxes.

“The government cannot expect Nigerians to pay more taxes if they cannot send their children to school, afford medical bills or even buy food,” he said, adding that tax revenue should be used to fight poverty, unemployment, insecurity and poor infrastructure.

Falana further criticized provisions that exempt some wealthy companies, especially those operating in free trade zones, from paying taxes. He described such exemptions as unjust and unconstitutional.

“If you want to engage in progressive taxation, the rich must pay much more than the poor, but the reverse is the case under the new tax regime,” he said.

He concluded by warning that once the laws are properly passed and implemented, the Federal Government should expect legal challenges over what he described as a discriminatory tax system.